OVERVIEW

“Machinery & Equipment"

The Machinery and Equipment (M&E) Subsector in Malaysia is a significant contributor to the country's economy, accounting for approximately 7% of the country's Gross Domestic Product (GDP). The M&E Subsector includes various industries, such as precision machining, automation and robotics, medical devices, and aerospace.

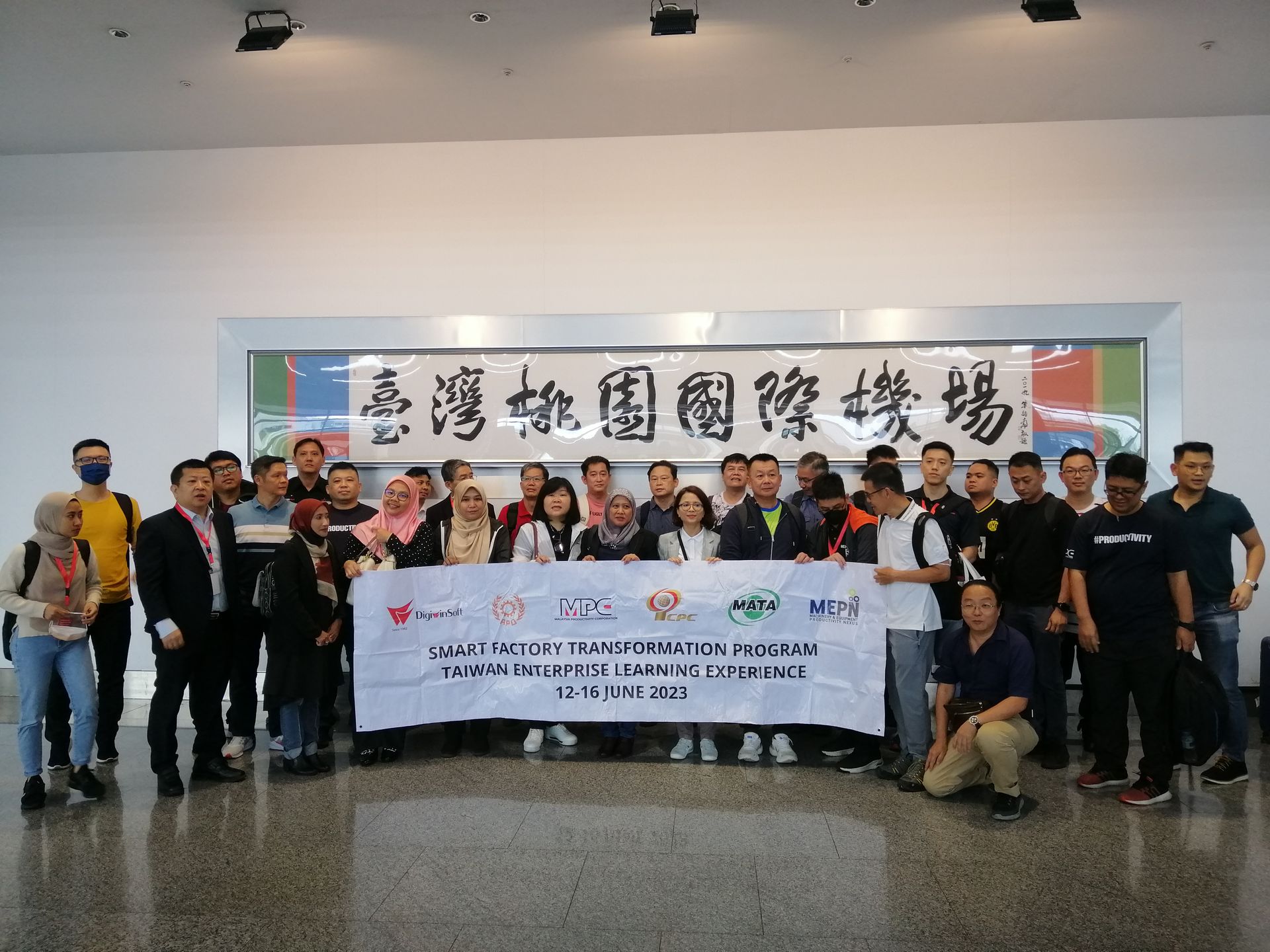

The Malaysian government has identified the M&E Subsector as one of the main focus areas for growth and expansion, with the Ministry of Investment, Trade and Industry (MITI) indicating that Malaysia has the potential to be a leading regional producer and exporter of M&E. The Malaysian Investment Development Authority (MIDA) has also positioned Malaysia as the destination of choice within the ASEAN region for the M&E Subsector , with forecasted growth of 10.1% per annum between 2018-2027.

Malaysia's conducive business ecosystem for the M&E Subsector has attracted internationally renowned and advanced M&E companies such as SKF, VAT, Oerlikon Balzers, Favelle Favco, Vitrox, SRM, and FMC, among others. Additionally, SMEs account for more than 95% of M&E players in Malaysia.

In terms of contribution to the economy, the M&E Subsector plays a critical role in supporting various industries, including the manufacturing, construction, and transportation sectors. The M&E Subsector also contributes significantly to job creation, with over 100,000 people employed in the sector in 2021.

The M&E Subsector is a vital component of Malaysia's economy, with its growth and expansion playing a crucial role in the country's economic development and global competitiveness.

Productivity Performance

The Machinery and Equipment (M&E) subsector in Malaysia has shown steady growth, with value added rising from RM 8 billion in 2017 to RM 10 billion by 2022. Despite fluctuations, the subsector’s productivity growth peaked at 9.7% in 2021, outperforming the national growth rate, and ended at 2.2% in 2023 compared to the national rate of 0.9%.

Labor productivity in the M&E subsector has consistently exceeded national levels, growing from RM 84,547 in 2017 to RM 101,288 in 2023. The robust growth in value added and labor productivity underscores the M&E subsector’s critical contribution to economic development, solidifying its position as a key driver of productivity, underscoring its efficiency and strategic importance to Malaysia’s economic growth.

Challenges

The M&E Subsector faces significant challenges in adapting to the digital age due to a reluctance to change and a preference for traditional business practices. This mindset, coupled with a lack of skilled talent to meet industry demands, hinders productivity growth and progress in the industry. Small and medium-sized enterprises (SMEs) are particularly affected due to their short-term profit mindset and limited adoption of productivity systems. Additionally, the high cost of digital transformation presents a financial barrier to entry. A gradual transition to digitalization with proper planning and resource distribution is necessary for a successful win-win strategy.

Talent and manpower pose additional challenges to the M&E Subsector with the ongoing Fourth Industrial Revolution constantly challenging business operations. To keep up with the latest technology and perform tasks in new ways, human capital development must be proactive and provide continuous training. Institutions of higher learning and technical vocational education and training (TVET) institutions must be equipped with up-to-date knowledge and technology application to meet industry demands. A sufficient supply of talent from these institutions can alleviate the industry's burden of upskilling or reskilling employees.